Lyons Township Properties Reassessed

Tuesday, July 21, 2020

Mailing Contains Assessor’s COVID-19 Adjustment to Property Values

CHICAGO – Cook County Assessor Fritz Kaegi announced that reassessment notices were mailed to property owners of Lyons Township’s 30,045 residential, 6,396 condominium, and 6,166 industrial/commercial properties.

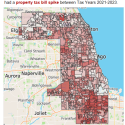

Each year, the Cook County Assessor’s Office (Assessor’s Office) reassesses one-third of the nearly 1.8 million parcels of property located in Cook County, a process referred to as the triennial reassessment. The south and west suburbs of Cook County are reassessed this year. Lyons Township’s last triennial reassessment took place in 2017.

In typical reassessments, the CCAO relies on sales trends to estimate each home’s value in 2020. This year, due to the significant economic impact of the COVID-19 outbreak and the natural disaster proclamation by the Governor of Illinois, the CCAO has also, when appropriate, applied a COVID-19 Adjustment to the reassessment values reflecting the pandemic’s effects on the real estate market. Each property’s adjustment depends on its location and property type.

“This is an unprecedented crisis and we’re taking necessary steps to address it,” said Cook County Assessor Fritz Kaegi. “No action or appeal is necessary for eligible properties to receive this adjustment.”

In the 2020 reassessment of homes in Lyons:

- Sale prices of homes have been stable in recent years. In 2019, of the single-family homes in Lyons that sold, the median sale price was $300,000.

- The CCAO’s median COVID-19 adjustment to estimates of value was -10.46%.

- The CCAO’s median estimated market value of a home in Lyons in 2020 was $260,770.

In the 2020 reassessment of commercial and industrial properties in Lyons:

- Commercial and industrial properties have seen stable growth in value over the last three years due to a low interest rate environment, increasing rental rates, and capitalization rate compression. Capitalization (“cap”) rates have been adjusted when appropriate to encompass the economic events that have transpired since the onset of the COVID-19 pandemic.

- For example, Lyons is home to 263 large apartment buildings (containing 6 or more units). In the valuation of these buildings, the cap rates used in 2017 ranged from 11.5% to 13.15%, and in 2020 ranged from 7.5% to 8.5% after adjusting for COVID-19. The resulting 2020 estimated market value per apartment unit ranged from $50,018/unit to $275,433/unit.

For more details about real estate trends and reassessment data about Lyons Township’s homes, condos, smaller apartments, offices, commercial/retail buildings, and industrial buildings, see the full reports at:

www.cookcountyassessor.com/Lyons-2020

Any changes to a property’s assessed value in 2020 will affect second installment property tax bills mailed in July 2021.

Taxpayers who wish to file an appeal of their property’s assessed value can file until August 14, 2020, and can submit online at www.cookcountyassessor.com/online-appeals.

“I encourage all taxpayers to take the time to visit our new website and review the detailed methodology reports as we continue to post them online,” Assessor Kaegi said. “I remain committed to increasing transparency and will continue to monitor the economic impact of COVID-19.”