How Commercial Properties Are Valued

Legal Obligation

Our legal obligation is set by two statutes:

Illinois Tax Code: Our duty is to determine “fair cash value” (or what most of us call fair market value) for Cook County properties on a triennial basis

Cook County ordinance: Assess at 10% for residential and apartments and 25% for most other commercial properties

Commercial Assessment Methodology

How the CCAO determines Assessed Values for Commercial Properties

Reassessment starts with revaluation. To produce a fair estimate of market value and a fair assessment of most commercial income-producing properties during a reassessment year, the CCAO undertakes the following steps:

- Determine a property’s use by reviewing the property’s history, including property class, tenants, business, and external photography of the parcel. It is important to understand the property’s characteristics to accurately group it with similar properties.

- Estimate the income generated by the property, and expenses. Most often, rent is the primary source of income for commercial property. Other incidental income streams may include fees from parking or advertising signage. Expenses include property taxes, insurance, repair and maintenance costs, property management fees, and service expenditures for professional services.

- Examine market-level vacancy based on location and property type. Some level of commercial property vacancy is normal and expected. The CCAO does consider reductions as a result of vacancy when a building is not serving its intended use due to conditions outside the control of the property owner, such as a casualty event or other localized factors, or new construction that has not yet been leased.

- Produce capitalization rates. Once we’ve been able to recreate a snapshot of a property’s income statement based on market data, we use a standard valuation metric called a “capitalization rate” to convert income to value. This capitalization rate (or cap rate) quantifies the relationship between a single year’s Net Operating Income (income minus expenses) and the total property value.

Cap rates have an inverse relationship to value. Properties with lower cap rates tend to have higher values. Properties with higher cap rates tend to have lower values.

- To estimate building value, divide its estimated income by cap rate. A property with $100,000 of net income, divided by a 9.5% cap rate, has an estimated market value of $1,052,631. A 6.5% cap rate generates an estimated market value of $1,538,461.

- Apply Level of Assessment, per County ordinance. A property’s assessed value depends on its market value and its level of assessment (LOA). Since 1973, the Cook County Board has passed ordinances to set different levels of assessment depending on the property’s use. Multifamily properties have a 10% LOA. A multifamily building valued at $1,000,000 has an assessed value of $100,000. Commercial properties like office and retail buildings have a 25% LOA. A commercial building valued at $1,000,000 has an assessed value of $250,000.

Note that the CCAO administers incentives that permit a reduced assessment for some multifamily, commercial, and industrial properties. The goal of these programs is to promote economic development and neighborhood vitality. Learn more here.

- Send notice of reassessment. Many buildings are divided into multiple Property Index Numbers (PINs). Owners of multiple PINs will receive multiple reassessment notices containing the assessed value of each PIN.

Here are some additional details about the methodology behind our income-based approach.

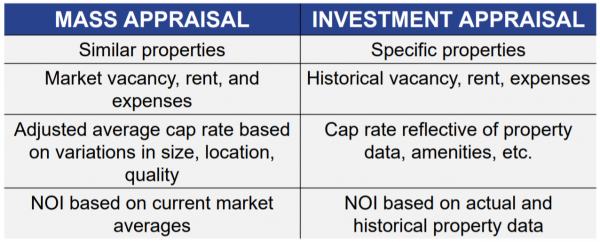

Mass appraisal vs. investment appraisal

Mass appraisal - used by the Cook County Assessor's Office - is different from investment appraisal, which is used by most investors.

Mass appraisal

- Determines the average levels for the inputs of valuation, rents, vacancy, expense ratio, cap rates

- Applies those averages uniformly to similar properties in similar neighborhoods to create individual values

Investment appraisal

- Determines the unique characteristics of a property

- Uses those unique characteristics to determine a specific, not average, value

Data Sources

We use CoStar, Trepp, CBRE, Cushman and Wakefield, JLL and other professional market data providers as we research the current market rents, vacancy, expenses, and cap rates. In addition, we do qualitative interviews with local brokers, appraisers, and building owners for insights.

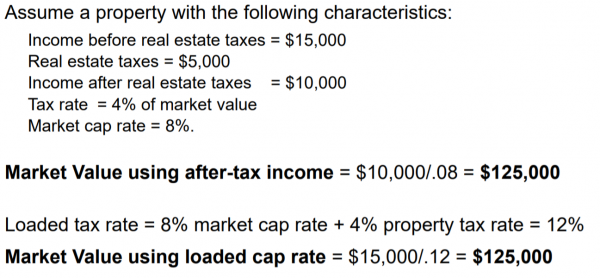

Loaded vs. unloaded cap rates

Our office uses an unloaded cap rate when assessing commercial properties. Other jurisdictions use a loaded cap rate. Our office is occasionally asked why we don't. Let's start with definitions:

Unloaded: Net income after real estate taxes are capitalized by the market cap rate.

Loaded: Net income before real estate taxes are capitalized by a loaded cap rate. Loaded cap rates are the market cap rate for a property plus the appropriate tax rate for that property.

The simple answer is Cook County's tax rates are not fixed; they change based on local levies and equalized assessed value. It’s not possible to predict taxes without knowing the levy or rate on the date of assessment (January 1st).

Rates are determined more than a year later and taxes are paid as much as 18 months later. Loading a cap rate would be speculative rather than being reflective of the market. Therefore, we consider taxes paid by a property owner to be part of the expenses of a property.

The International Association of Assessing Officers recommends either accounting for taxes as an expense or loading it into the cap rate in an income-based approach.

Note: Illinois Tax Code does not make a recommendation for loaded versus unloaded cap rates.

If all properties know and agree on what is the fair tax rate for a property, using an unloaded or loaded valuation methodology will generate exactly the same result. Here's an example:

Valuations Reports

The township-level reports containing information on the data used in our commercial valuations can be found in our Valuations Reports section.

Enter PIN to see property details

Don’t know your PIN? Search by address here.