How Residential Property Is Valued

The job of the Cook County Assessor’s Office is to calculate a fair market value for your property. In calculating fair market value for residential properties, we consider what the fair cash value would be for your property if it had sold recently in its reassessment year. For residential properties, your property’s assessed value equals 10% of its fair market value, per Cook County ordinance.

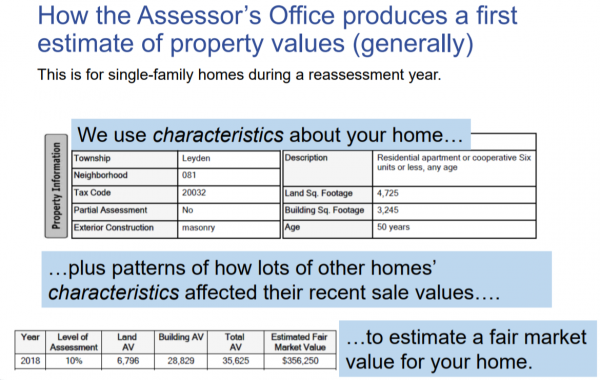

The Assessor's estimate of your home's fair market value is based on two things: your home's characteristics, and patterns between how other homes' characteristics affected their sale values. We use recent sales of homes similar to yours, in and around your neighborhood, to estimate your home’s value. Homes more similar to yours, or closer geographically to yours, make more of a difference in our calculation than other homes.

Because sale values of homes are affected by their characteristics - such as its square footage, age, and location - we use statistical modeling to use those characteristics to produce property values for each home. Our assessment models consider several different characteristics of homes including, but not limited to, land, location, building square footage, and construction type.

Mass appraisal leverages vast amounts of sale data to detect trends in how sale prices are affected by characteristics. Our office uses a Computer Assisted Mass Appraisal (CAMA) system and skilled residential analysts to produce estimates of property values. Some neighborhoods have higher sale prices than others. Smaller homes tend to have lower sale prices and larger homes tend to have higher sale prices. The CCAO’s CAMA system detects patterns in this data to estimate the dollar amounts of how each of these characteristics may have pushed sale values up or down.

As a purely hypothetical example, say each +1 square foot for a building might on average add $50 in value, each +1 year in age might subtract $500 in value, and having a porch might add $5,000 in value. Each of these estimates are part of a model. The CCAO’s code produces hundreds of different models, each using different methods to calculate how combinations of characteristics are associated with changes in sale values. (Note that sometimes a change in a characteristic might not be associated with a change in value for a given area, and the code can detect linear patterns like the above hypothetical example, as well as more complicated non-linear patterns).

We test each model’s accuracy by comparing the model’s estimate of a home’s value (based on its characteristics) to its actual sale price. The code tests hundreds of different models to see which one produces the most fair and accurate estimates in accordance with international standards for best practices for fair assessment. Once we have selected the best-performing statistical model, we use it to estimate the values of all individual homes - those with and without a recent sale - in a geographic area.

The CCAO’s analysts review these estimates, neighborhood by neighborhood, and correct individual properties’ assessments as needed. After our analysts complete all reviews and update these property values, the initial values for that township are complete and the CCAO mails an assessment notice to the property’s owner, containing the home's characteristics and initial value estimated by the CCAO.

We post reports on all residential and commercial assessments by township on our website. Each residential township report shows home sale trends and assessment changes for every neighborhood. We also publish self-evaluation of our assessment quality, based on measurements developed by the International Association of Assessing Officers. Together, these reports show the accuracy of our work and provide property owners with data they can use to evaluate the accuracy of the assessments of their homes and neighborhoods.

We released a more detailed explanation of how this works here. We also released all the code for our residential models publicly on GitHub, a platform that hosts open source data. You can view our modeling pipelines for single-family homes, and for condos. You can also review our models and the results of our model on the Cook County Open Data Portal here.

Enter PIN to see property details

Don’t know your PIN? Search by address here.