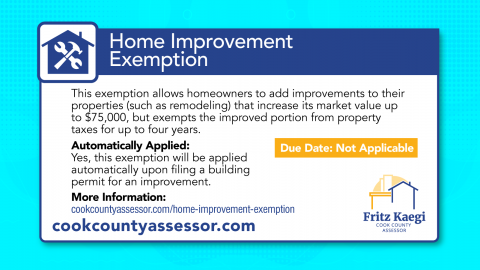

The Home Improvement Exemption allows a homeowner to add improvements to their home that add to its value (for example, by increasing the building’s square footage, or repairing after structural flood damage) without being taxed on up to $75,000 of the added value for up to four years.

No application is required. When the Cook County Assessor’s Office receives building permits, our staff conduct a field check of the improvement. After this is complete, if this property is deemed eligible for the exemption, we send a notice to the property owner and apply the exemption.