.png)

The Assessor's Role in the Property Tax System

The Cook County property tax system is complex. It involves the Assessor's Office, the Board of Review, the Cook County Clerk, and the Cook County Treasurer. Plus, the Illinois Department of Revenue. How much you pay in taxes depends on your property's assessment, assessments of other properties, appeals, exemptions, and local tax levies. In this section, we explain all of it.

The CCAO produces fair market values for properties. Values are finalized by the Cook County Board of Review after appeals have concluded with the CCAO and the Board of Review. Assessed values -- the values used to calculate property taxes -- depend on the fair market value and the class type of the property.

Assessments are analyzed by the Illinois Department of Revenue, which calculates the State Equalization Factor each year after assessments are concluded. This Factor is a single number for all of Cook County that is multiplied to a property's assessed value to determine a property's Equalized Assessed Value. The Equalized Assessed Value is used to calculate property tax bills.

Property tax bills are affected by exemptions and property tax rates. The Cook County Clerk calculates tax rates. The Cook County Treasurer sends property tax bills, collects property tax revenue, and distributes it to taxing districts to fund services (like schools).

Read how a residential property tax bill is calculated here.

The Role of the Cook County Assessor

The Cook County Assessor is an elected government official who is responsible for establishing fair and accurate property assessments. Valuation of the county's 1.8 million parcels of property is conducted for ad valorem tax purposes. Ad valorem means according to value and refers to the amount of taxes that will be required to be paid based on the value of the property.

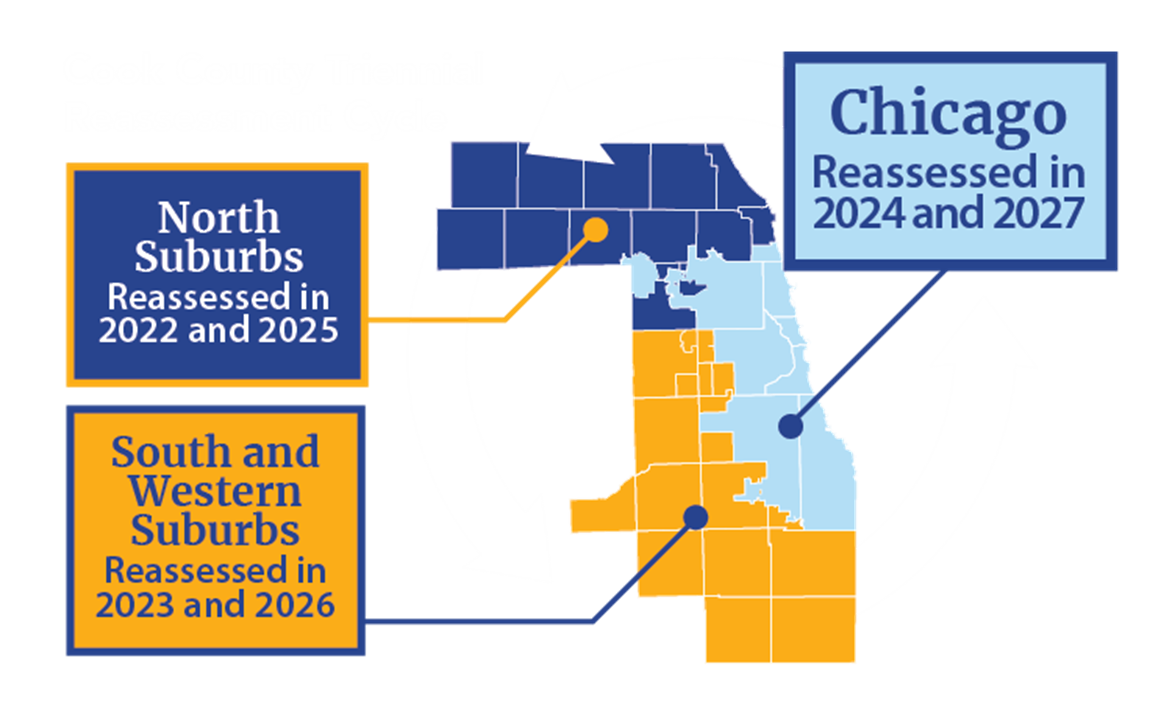

To administer this task, the Assessor reassesses one-third of the properties located in the county each year. The Assessor alternates assessments among the northern suburbs, the southern suburbs and the City of Chicago.

The Assessor's public service responsibilities, however, are not limited to setting property values. In addition to working with other government agencies to stimulate economic development, job creation and the construction of affordable housing, the Assessor also seeks to help county residents better understand the assessment process and take advantage of money-saving exemptions the office provides.

The Cook County Assessor places a value on close to 1.9 million parcels in Cook County

Triennial Reassessments

Reassessment of property in Cook County is done within a triennial cycle, meaning it occurs every three years. The Cook County Assessor's Office alternates reassessments between the north and west suburbs, the south and west suburbs and the City of Chicago.

City of Chicago Townships

| North Suburban

|

South and Western Suburb

|

Valuation Through Multiple Regression

To determine the property value of a single-family home, the Assessor's Office uses a technique called multiple regression. This technique creates a type of sales comparison average, a mathematical relationship between the value of your house and those of your neighbors. It follows similar steps that an appraiser would take when valuing a single-family home. The key concern in residential property assessment is uniformity. The rule of uniformity requires that property be valued with property of like kind. The sales comparison average ensures that similar properties are assessed similarly.

Mapping the Townships

An integral part of the reassessment process is the collection of data regarding economic and neighborhood trends. The data is then used to define neighborhoods which have similar housing types and sale prices. The defined neighborhoods are then mapped and assigned neighborhood codes, a necessary component of the multiple regression process.

In suburban townships or Chicago neighborhoods which will undergo triennial reassessments, the Assessor's staff meets with local elected officials, community leaders, real estate professionals and other citizens knowledgeable about real estate in the area. This helps to verify or correct assessment neighborhood boundaries before they are finalized.

The Appeals Process

With nearly 1.8 million parcels of property in Cook County, mistakes may occur during the reassessment process. The Assessor's Office encourages taxpayers to review their proposed assessments and file appeals if necessary. The assessor has a friendly and informative staff available to help taxpayers file appeals.