Worth 2020

Reassessment notices for properties in Worth were mailed to property owners on June 17, 2020. The property values on this notice have been adjusted, when appropriate, with a COVID-19 Adjustment based on our Office's estimates of economic effects of COVID-19.

For more details, read the full reports below.

View video presentation below, Worth by the Numbers.

By The Numbers - Worth Township

Posted by Cook County Assessor's Office on Wednesday, July 1, 2020

Residential Report:

| Property type | Property count | Median 2019 Sale Value | Median COVID Adjustment | Median 2020 CCAO Estimated Fair Market Value | Median change in 2017-2020 CCAO Estimated Fair Market Value |

|---|---|---|---|---|---|

| Single-family homes | 41,506 | $196,000 | -10.7% | $171,270 | -2.0% |

| Condos (class 2-99) | 12,427 | $88,950 | -10.7% | $74,820 | -11% |

| Apartments of 2-6 units | 1,840 | $330,000 | -13.6% | $268,490 | 3% |

Read the full 2020 Worth Residential Reassessment Report for more real estate data, COVID-19 adjustments, and reassessment data for each neighborhood.

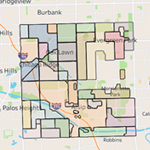

Interactive Map:

Find your neighborhood, and data about single-family homes in Worth, on the interactive map.

- number of homes and most common type of single-family homes in each neighborhood

- sale data for each neighborhood

- assessment data for each neighborhood

- note: to see COVID-19 Adjustments for each neighborhood, please read the full Worth report.

- For more details on how COVID-19 Adjustments were calculated, see our report.

Commercial Report:

- 540 apartment buildings (larger than 6 units)

- 451 office buildings

- 1,389 commercial/retail buildings

- 438 industrial buildings

The Worth Commercial Properties reassessment report contains details about the COVID-adjusted cap rates used to produce CCAO estimates of Fair Market Values.

Total Assessed Value Changes

Initial property assessments are determined by the Assessor's Office after the office has heard all assessment appeals. Property owners can also file an appeal with the Cook County Board of Review before final assessed values are set.

The following report details the effects of appeals at the Board of Review on the assessed value of Worth Township as well as the largest parcels in this township.

Worth 2020 Total Assessed Value Report

For a complete dashboard of 2020 total assessed values for each township, read the Township Assessed Value Report: Tax Year 2020.

Appeals

If you are looking to file an appeal, we encourage you to file online. The appeal deadline for Worth is July 23, 2020.

For assistance, you can contact the CCAO's main office, or the office of the Worth township assessor.

Enter PIN to see property details

Don’t know your PIN? Search by address here.