The Assessor's Office released its initial assessments of residential and commercial properties in Wheeling Township on October 10, 2022.

The Assessor's Office released its initial assessments of residential and commercial properties in Wheeling Township on October 10, 2022.

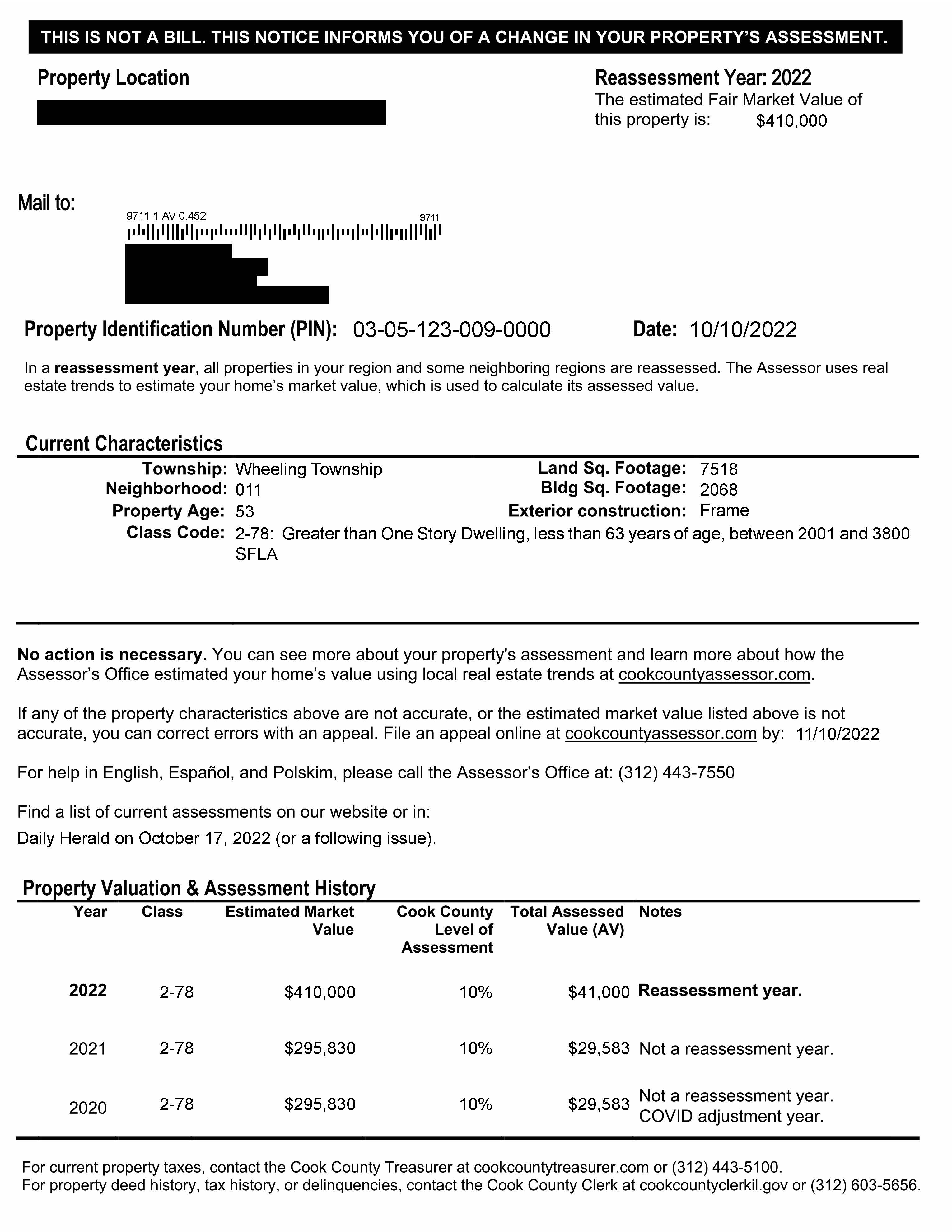

The Assessor’s Office follows a triennial reassessment cycle, which means one-third of the county is reassessed every three years. The townships scheduled for reassessment in 2022 can be found here. When a property is reassessed, the property owner is mailed a Reassessment Notice, which contains the property’s address, characteristics, and estimated Fair Market Value. The estimated Fair Market Value listed on the Reassessment Notice will be reflected on tax bills in 2023.

Numbers at a Glance: Residential

-

In 2021, the median sale price for single-family homes was $369,000; for condos, the median sale price was $169,000; and $610,000 for small apartment buildings.

-

The assessor’s median market value estimate for single-family homes in 2022 is $360,000; for condos, the median market value is $161,000; and $534,000 for small apartment buildings.

Residential Reassessment

Report

Numbers at a Glance: Commercial

Commercial property assessments are based on the income generated by those properties. Increases in rents and income of commercial property lead to increases in their estimated market value.

- Rent for large multi-family apartment buildings ranges from approximately $1,023 to $2,484 with an average vacancy rate of 5% and an average cap rate of 6.64%.

- Industrial properties average $6.55 per square foot in rent with an average of 5% vacancy and 8.37% cap rate.

- The average rent for standalone commercial properties varies from approximately $18-27 per square foot with an average vacancy of 10-15% and cap rates from 7% to 9%.

Commercial Reassessment

Report

Appealing property assessments

If the property characteristics listed on an assessment notice are incorrect, or if the estimated market value of a property is significantly more than what it could sell for in the current real estate market, property owners should consider filing an appeal.

Appeals for Wheeling Township can be filed until November 10, 2022. More information can be found at cookcountyassessor.com/appeals. To learn more about property assessments and appeals, join the Assessor’s Office at a virtual event and download this helpful guide.

Changes in Assessed Value in Wheeling Township

The total assessed value of the township grew 34% due to increases in residential and commercial property values and the construction of new properties.

|

Property Group |

2021 (Board of Review Final) |

2022 (pre-CCAO appeals, pre-Board of Review) |

Increase in total Assessed Value |

|

Residential (Class 2) |

$1.3B |

$1.7B |

$372M (27%) |

|

Commercial Apartments (Class 3) |

$78M |

$150M |

$72M (92%) |

|

Not-For-Profit |

$3K |

$3K |

$0K (-3%) |

|

Standalone Commercial (Class 5A) |

$361M |

$518M |

$157M (43%) |

|

Industrial |

$154M |

$237M |

$83M (54%) |

|

All other classes |

$41M |

$51M |

$10M (25%) |

|

Total |

$2.0B |

$2.7B |

$693M (34%) |

Percentage increases are total increases for that category, not average property increases. If the percentage increase of a Wheeling Township property’s individual assessment went up less than the total assessed value increase of 34%, the property could see little change in its property tax bill or even a decline. The full impact of this reassessment on tax bills will be known in late 2023 after all appeals are processed and exemptions are applied.

How Assessments Relate to Property Taxes

Assessments, under Illinois law, should fairly reflect market values. The Assessor’s Office estimates market values by using a mass appraisal model that analyzes sales trends. Mass appraisal models rely on accurate data. If a property owner believes the characteristics listed for their property are inaccurate, or their property is worth less than the Assessor’s Office’s estimate of its value, the owner is entitled to file an appeal.

These assessments divide up the total tax levy of that property’s township, school district, and other taxing districts. A property owner’s share of taxes depends on how their property’s assessment relative to the total assessed value of their area. Therefore, an increase in a property's assessment does not lead to the same increase in its tax bill.

Tax levies pay for services such as schools, parks, libraries, and pensions. The Assessor does not set levies or tax rates. Increases in assessments do not increase the revenue received by taxing districts.

Receive Property Tax Assistance: Wheeling Township

Watch a virtual workshop to learn about recent reassessments in Wheeling Township.

- Understand your reassessment notice

- How to determine if an appeal should be filed

- Learn how to file for missing exemptions

- Participate in a live Q&A session