Property reassessments released for South Chicago Township

Tuesday, October 5, 2021

Residential and commercial properties in South Chicago show robust growth

The Cook County Assessor’s Office released initial assessments of residential and commercial properties in the township of South Chicago. This is the fifth of eight townships in the City of Chicago to be reassessed in 2021 under the leadership of Assessor Fritz Kaegi, who took office after Chicago’s last reassessment in 2018.

“We’ve seen similar, surprisingly robust real estate trends in South Chicago that we’ve seen in other areas of the city,” said Assessor Kaegi. “In some areas, home values are rising significantly, though others have plateaued. Despite the pandemic, downtown rents have increased since 2018, driving some commercial property values higher while others still see ongoing economic effects from the pandemic. This is especially true for some retail properties.”

Increases in assessments reflect a strong market. Assessments, under Illinois law, should reflect overall market values. The first step to ensuring property owners pay only their fair share of property taxes—without needing to file appeals to correct inaccurate assessments—is to make sure assessments of all property types accurately reflect the real estate market.

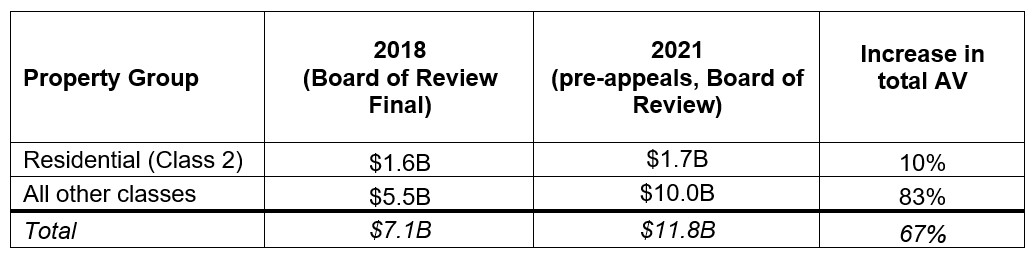

Changes in assessed value in South Chicago Township

The following chart represents the increase in total assessed value in residential and commercial properties in South Chicago Township.

Note: Percentage increases and total increases are for all properties in that category. Assessment increases or decreases to individual properties vary, depending on each property’s location and characteristics.

How assessments relate to property taxes

An increase in a property's assessment does not lead to the same increase in an individual property’s tax bill. A property’s share of taxes depends on reassessments throughout all of Chicago, from homes in Chatham and Jefferson Park to commercial properties in Little Village and the Loop.

Property reassessments are ongoing for Chicago’s remaining six townships. If the growth in assessed values throughout Chicago outpaces the growth of the assessed value of an individual property in South Chicago Township, that individual property’s share of property taxes could shrink despite its increase in property value.

Property assessments in Chicago are used to apportion taxing district levies, which pay for services such as schools, parks, libraries, and pensions. The Assessor does not set levies or tax rates. In addition, increases in assessments do not necessarily increase the revenue received by taxing districts.

At the end of the 2018 reassessment cycle, 22% of South Chicago Township’s total assessed value was residential, with the other 78% comprised non-residential and commercial multi-family properties.

The 2021 initial reassessed values have shifted this to 15% residential, and 85% non-residential and commercial multi-family properties.

These percentages may change at the final stage of assessment after appeals are processed by the Assessor's Office and by the Board of Review.

The 2021 assessments will affect the second installment property tax bill issued in late 2022.

Residential assessments

- In 2020, median sale prices of single-family homes in South Chicago Township were about $420,000 for single-family homes and $280,000 for condos.

- In its assessment models, the Assessor’s Office estimated most single-family homes have a 2021 market value between $280,000 and $420,000, and most condo values were between $250,000 and $350,000. Estimates depend on the individual property’s location and characteristics.

The assessments for single-family homes met all three International Association of Assessing Officer standards for high-quality assessments.

Third-party reporting, including a 2017 report in the Chicago Tribune, showed that the previous reassessments of the City of Chicago resulted in the overassessment of some lower-value homes while higher-value homes typically were underassessed.

Commercial assessments

Hotels and retail properties are among the sectors with the largest declines since the onset of COVID, whereas rents in multi-family apartments, grocery stores, industrial buildings, and data centers have been stable or experienced positive growth since the onset of COVID. In the Assessor’s Office 2021 models:

- Market rents for apartments in South Chicago range from $650 to $4550 a month.

- Market vacancy is between 7 and 16%.

- Market values are estimated from $39k to $648k per unit.

Affordable housing figures are calculated separately and listed in the complete commercial assessment report.

- Office buildings in South Chicago range in size from 364 to 4.6M in square footage and are assessed at $9 - $45 in rent per square foot with 3-15% market vacancy.

- Estimated market values are $104-$839 per square foot.

A report from the International Association of Assessing Officers stated that commercial properties in Chicago were underassessed in 2018, which may have shifted some of the property tax burden from commercial properties to residential properties. The 2021 reassessments reflect current market data and commercial property’s share of the market.

Access all residential and commercial reports—including multi-family assessments, detailed studies of residential assessment quality, and commercial data sources and methodology—at cookcountyassessor.com/valuation-reports.

Where is South Chicago Township?

South Chicago Township is bordered by Lake Michigan on the east and Pershing Road on the southern border. On its western border, it follows the Stevenson Expressway and the Chicago River to its most northern point at Wacker Drive.

Appealing property assessments

If the property characteristics listed on an assessment notice are incorrect, or if the estimated market value of a property is significantly more than what it could sell for in the current real estate market, property owners should file an appeal.

Property owners are encouraged to use the Assessor’s Office's new, award-winning online system to file their appeals.

Appeals for South Chicago Township can be filed until November 1, 2021. More information on filing appeals can be found at cookcountyassessor.com/appeals

To learn more about property assessments and appeals, join the Assessor’s Office at a virtual event listed here: cookcountyassessor.com/event-list.