Property Reassessments Begin in Cook County’s North Suburbs

Thursday, July 7, 2022

First reassessments released for Norwood Park Township

Cook County – Cook County Assessor Fritz Kaegi released the initial assessments of residential and commercial properties in Norwood Park Township on July 1, 2022. Property owners can expect to receive their Reassessment Notice in the mail within the week.

The Assessor’s Office follows a triennial reassessment cycle, which means one-third of the county is reassessed every three years. When a property is reassessed, the property owner is mailed a Reassessment Notice. The Reassessment Notice reflects the estimated fair market value based on sales of similar property over the past three years. The notice also contains important information such as property characteristics, neighborhood code, and past assessment information. An increase in a property’s value does not indicate the same increase in the property owner’s taxes.

Changes in Assessed Value

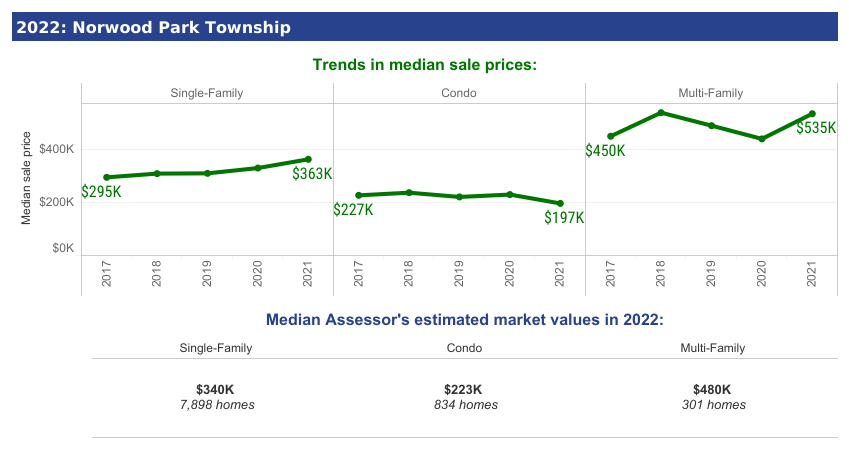

Residential assessments are based on recent sale prices of similar properties. The 2021 median sale price for single-family homes in Norwood Park was $363,000; for condos, the median sale price was $197,000, and was $535,000 for small apartment buildings.

The assessor’s median market value estimate for single-family homes in 2022 is $340,000, for condos the median market value is $223,000, and is $480,000 for small apartment buildings.

Commercial property assessments are based on the income generated by those properties. Increases in rents and income of commercial property led to increases in their estimated market value. Rent for large multi-family apartment buildings in Norwood Park ranges from $650 to $2800 with an average vacancy rate of 5% and an average cap rate of 8.31%.

Industrial properties in Norwood Park average $7.30 per square foot in rent with an average 5% vacancy and 8.97% cap rate.

The average rent for standalone commercial properties varies from $8-27 per square foot with an average vacancy of 5-14% and cap rates from 7.5-9.5%.

Summary of Assessed Value

Because of increases in the value and/or number of properties throughout Norwood Park, the total assessed value of the township grew 32%. The following table shows the increase in total assessed value in residential and non-residential properties in Norwood Park Township.

| Property Group | 2021 (Board of Review Final) | 2022 (pre-CCAO appeals, pre-Board of Review) | Increase in total Assessed Value |

| Residential (Class 2) | $256M | $332M | $76M (30%) |

| All other classes | $102M | $140M | $140M |

| Total | $358M | $472M | $115M (32%) |

If the percentage increase of a Norwood Park property’s individual assessment went up less than the total assessed value of 32%, the property could see little change in its property tax bill or even a decline. The full impact of this reassessment on tax bills will be known in late 2023 after all appeals are processed and exemptions are applied.

Norwood Park Township is the first of thirteen townships located in the North Suburbs of Cook County which will be reassessed this year for Tax Year 2022. The full schedule for reassessments in 2022 can be found on the Assessment & Appeal Calendar.

The Assessor’s Office provides detailed residential and commercial reports—including multi-family assessments, detailed studies of residential assessment quality, and commercial data sources and methodology. The Valuation reports for Norwood Park Township can be found at cookcountyassessor.com/valuation-reports.

Appealing property assessments

If the property characteristics listed on an assessment notice are incorrect, or if the estimated market value of a property is significantly more than what it could sell for in the current real estate market, property owners should consider filing an appeal.

Appeals for Norwood Park Township can be filed until August 2, 2022. More information can be found at cookcountyassessor.com/appeals.

To learn more about property assessments and appeals, join the Assessor’s Office at a virtual event and download a helpful guide.