Calumet Township Properties Reassessed

Wednesday, May 6, 2020

Supplemental Mailing will Contain Assessor’s COVID-19 Adjustment to Property Values

CHICAGO – Cook County Assessor Fritz Kaegi announced that reassessment notices were mailed to 4,126 single-family, 370 condominiums, and 529 industrial/ commercial property owners in Calumet Township.

Notices contained initial estimates of 2020 market values, which were calculated earlier this year, prior to COVID-19. All Calumet property owners will receive a second mailing with information about the Assessor’s COVID-19 Adjustment to their properties’ estimated market values, and their properties’ CCAO Final 2020 Market Values.

“This is an unprecedented crisis and we’re taking necessary steps to address it,” said Cook County Assessor Fritz Kaegi. “No action or appeal is necessary for eligible properties to receive this adjustment.”

Detailed narrative reports explaining the methodology for the reassessment are available on the Cook County Assessor’s website at:

www.cookcountyassessor.com/valuation-reports

“These reports are part of our office’s commitment to increase transparency and provide greater predictability within our assessment system,” Assessor Kaegi said. “Calumet is the fifth township to be reassessed in the south suburbs and my office will continue to post comprehensive reports for the remaining townships as notices are mailed throughout the year.”

Each year, the Cook County Assessor’s Office (Assessor’s Office) reassesses one-third of the nearly 1.8 million parcels of property located in Cook County, a process referred to as the triennial reassessment. South suburban Cook County is reassessed this year.

The deadline to file an appeal for Calumet Township is May 26, 2020. Taxpayers who wish to file an appeal of their property’s assessed value can submit filings online at www.cookcountyassesor.com/online-appeals.

The 2020 south suburban reassessments will be reflected on the second installment property tax bill in July 2021. Any appeals of a property’s assessed value will be reflected on the second installment tax bill in the year following the appeal.

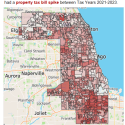

A detailed narrative and interactive map regarding the reassessment of residential properties in Calumet Township can be found on the Assessor’s website at the following link: www.cookcountyassessor.com/calumet-2020

Among the findings from the residential Calumet Township reassessment:

- In 2019, the median sale price of a single-family home in Calumet was $98,500. The percentage increase in sale price from 2016 to 2019 was 49%.

- The median estimated Fair Market Value (FMV) for a single-family home in Calumet Township in 2020 is $87,540. The 2017 median FMV was $95,930. The percentage decrease in FMV from 2017 to 2020 was 10%.

- Calumet has grown by approximately $29.4M (34.3%) in total assessed value from 2019 (Assessor-certified values) to 2020 (Assessor mailed values).

- The most common single-family home type in 2020 is a class 2-03: One story residence, any age, 1,000 to 1,800 square feet.

A detailed narrative regarding the reassessment of commercial/industrial properties in Calumet Township can be found on the Assessor’s website at the following link: www.cookcountyassessor.com/calumet-2020

Among the findings from the commercial/industrial Calumet Township reassessment:

- Fair market values of commercial properties have risen in Calumet Township since 2017.

- Market rents used in the 2020 reassessment were generally higher than rents used in the 2017 reassessment. This generates additional increases in market value (resulting in comparable increases in assessed value).

- The most powerful driver of increased values is a lower capitalization rate, driven by a low interest rate environment and increasing rental rates. For example, the range of cap rates used for apartments in 2017 was 11.8% to 12%, and in 2020 was 9% to 10%.

North suburban and Chicago portions of Cook County, which are not scheduled for reassessment, as well as all properties located in south and west suburban townships will all have their property values reviewed for estimated effects of COVID-19 following the appeal process. Property owners are not required to appeal in order to receive the COVID-19 review and adjustment for eligible properties.

“I encourage all taxpayers to take the time to visit our new website and review the detailed methodology reports as we continue to post them online,” Assessor Kaegi said. “I remain committed to increasing transparency and will continue to monitor the economic impact of Covid-19.”