Assessor Kaegi Reminds Property Owners that Many Exemptions will Auto-Renew this Year Due to COVID-19

Tuesday, February 2, 2021

Exemption applicants can now file online at Assessor’s website

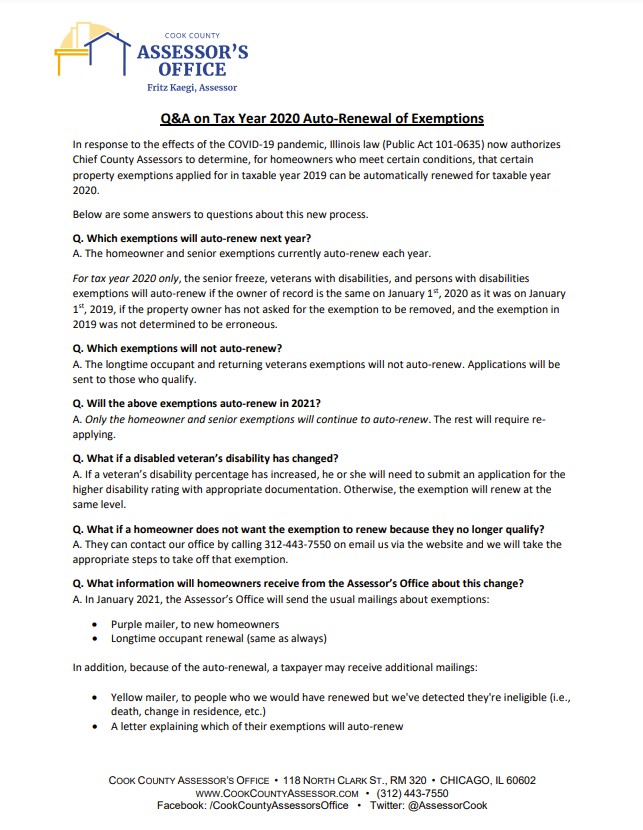

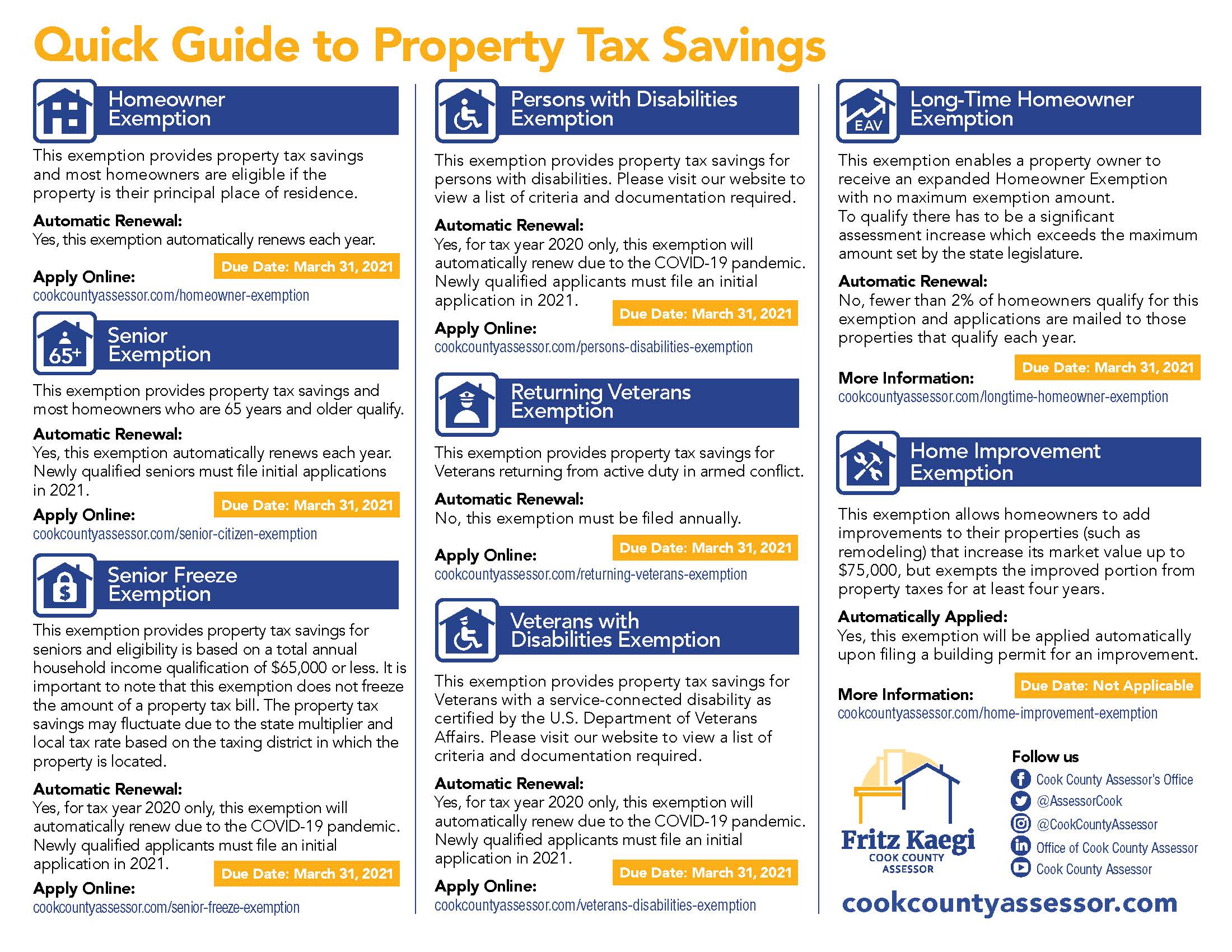

Chicago – Cook County Assessor Fritz Kaegi reminds property owners that due to the COVID-19 pandemic, the Illinois legislature is allowing the Assessor’s Office to automatically renew many property tax exemptions for tax year 2020. The following exemptions will automatically renew this year, for homeowners who received them last year for tax year 2019 and who remained eligible in 2020:

• Homeowner Exemption (annual auto-renewal)

• Senior Exemption (annual auto-renewal)

• Senior Freeze Exemption (2020 auto-renewal)

• Persons with Disabilities Exemption (2020 auto-renewal)

• Veterans with Disabilities Exemption (2020 auto-renewal)

.png) In the next couple of weeks, hundreds of thousands of households will receive mail from the Assessor that confirms the auto-renewal of the exemptions placed on their homes. All exemptions will be applied to the second installment property tax bills issued in summer of 2021.

In the next couple of weeks, hundreds of thousands of households will receive mail from the Assessor that confirms the auto-renewal of the exemptions placed on their homes. All exemptions will be applied to the second installment property tax bills issued in summer of 2021.

Property owners are advised that the first installment bill that was recently mailed to property owners does not reflect 2020 exemptions, assessment appeals, or assessment COVID adjustments. By law, it is 55 percent of the total taxes paid the previous year.

Cook County Assessor Fritz Kaegi, who pushed for the auto-renewals, said, “The COVID-19 pandemic has put tremendous pressure on Cook County homeowners. By facilitating auto renewal of selected exemptions and providing online filing for exemptions, we are hoping to keep more Cook County residents home and safe, while administering all the property tax savings they are eligible for.”

The Assessor’s Office also identifies households who may be newly eligible for exemptions (such as homes that recently sold before January 1, 2020) and homes that have not received an exemption in the last two years. The Assessor’s Office mails Taxpayer Exemption Booklets directly to these homeowners. The booklets contain applications and instructions on how to apply for the Homeowner, Senior, and Senior Freeze Exemptions if eligible. Applications will also be made available on the Assessor’s website at cookcountyassessor.com during the first week of February and are due March 31, 2021. In addition, the Assessor’s Office determines which properties may qualify under state law for the Longtime Homeowner Exemption, and mails an application to these homeowners.

Additional information regarding all exemptions may be found by visiting the Exemptions page on our website at cookcountyassessor.com/exemptions.

"Our office will continue our outreach online and in person throughout the county to increase awareness of our exemption programs and assist taxpayers with the application process,” Assessor Kaegi said. “I will continue to work to ensure that homeowners in Cook County do not pay more than their fair share of property taxes.”

Download these helpful resources.