Property reassessments released for Jefferson Township

Friday, August 20, 2021

Residential and commercial properties in Jefferson show robust growth

The Cook County Assessor’s Office released initial assessments of residential and commercial properties in Jefferson Township. This is the third of eight townships in the City of Chicago to be reassessed in 2021 and the third Chicago township to be reassessed under the leadership of Assessor Fritz Kaegi, who took office after Chicago’s last reassessment in 2018.

“We’ve seen similar, surprisingly robust real estate trends in Jefferson that we’ve seen in other areas of the city,” said Assessor Kaegi. “In some areas, home values are rising significantly, though others have plateaued. Despite the pandemic, rents have increased since 2018, driving some commercial property values higher while others still see ongoing economic effects from the pandemic.”

Increases in assessments reflect a strong market. Assessments, under Illinois law, should reflect overall market values. The first step to ensuring property owners pay only their fair share of property taxes—without needing to file appeals to correct inaccurate assessments—is to make sure assessments of all property types accurately reflect the real estate market.

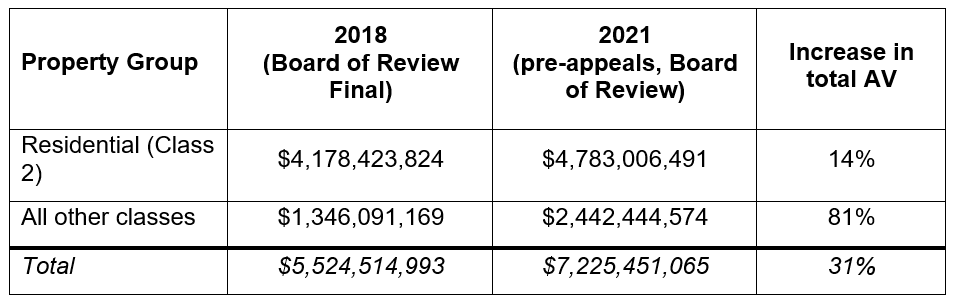

Changes in assessed value in Jefferson Township

The following chart represents the increase in total assessed value in residential and commercial properties in Jefferson Township.

Note: Percentage increases and total increases are for all properties in that category. Assessment increases or decreases to individual properties vary, depending on each property’s location and characteristics.

How assessments relate to property taxes

An increase in a property's assessment does not lead to the same increase in an individual property’s tax bill. A property’s share of taxes depends on reassessments throughout all of Chicago, from homes in Chatham and Jefferson Park to commercial properties in Little Village and the Loop.

Property reassessments are ongoing for Chicago’s remaining six townships. If the growth in assessed values throughout Chicago outpaces the growth of the assessed value of an individual property in Jefferson Township, that individual property’s share of property taxes could shrink despite its increase in property value.

Property reassessments are ongoing for Chicago’s remaining six townships. If the growth in assessed values throughout Chicago outpaces the growth of the assessed value of an individual property in Jefferson Township, that individual property’s share of property taxes could shrink despite its increase in property value.

Property assessments in Chicago are used to apportion taxing district levies, which pay for services such as schools, parks, libraries, and pensions. The Assessor does not set levies or tax rates. Also, increases in assessments do not necessarily increase the revenue received by taxing districts.

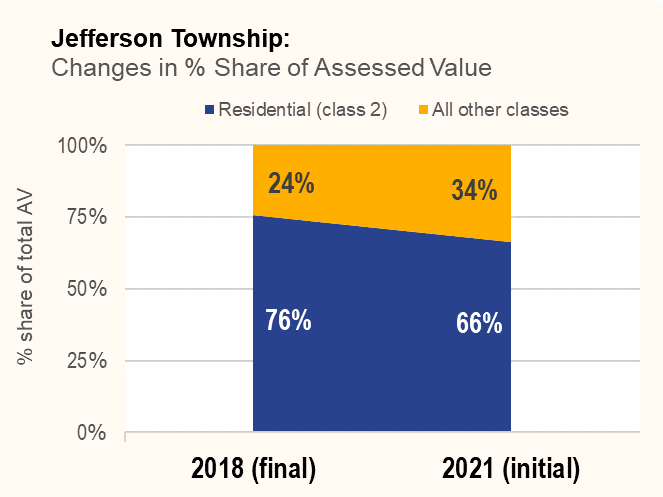

At the end of the 2018 reassessment cycle, 76% of Jefferson Township’s total assessed value was residential, with the other 24% comprised non-residential and commercial multi-family properties.

The 2021 initial reassessed values have shifted this to 66% residential, and 34% non-residential and commercial multi-family properties. These percentages may change at the final stage of assessment after appeals are processed by the Assessor's Office and by the Board of Review.

The 2021 assessments will affect the second installment property tax bill issued in late 2022.

Residential assessments

- In 2020, median sale prices of single-family homes in Jefferson Township were about $320,000 for single-family homes and $190,000 for condos.

- In its assessment models, the Assessor’s Office estimated most single-family homes have a 2021 market value between $300,000 and $380,000 and most condo values were between $140,000 and $200,000. Estimates depend on the individual property’s location and characteristics.

The assessments for single-family homes and multi-family apartments met all three International Association of Assessing Officer standards for high-quality assessments.

“Our assessments are tracking the market and we’ve improved uniformity of assessments for all,” said Assessor Kaegi. “This represents a significant leap forward for fairness within all parts of Chicago.”

Third-party reporting, including a 2017 report in the Chicago Tribune, showed that the previous reassessments of the City of Chicago resulted in overassessment of some lower-value homes while higher-value homes typically were underassessed.

Commercial assessments

Hotels and retail properties are among the sectors with the largest declines since the onset of COVID, whereas rents in multi-family apartments, grocery stores, industrial buildings, and data centers have been stable or experienced positive growth since the onset of COVID. In the Assessor’s Office 2021 models:

- Market values are estimated from $14,740 to $328,962 per unit.

- Market rents for apartments in Jefferson range from $638 to $1,800 a month.

- Market vacancy is between 3.8 and 7.90%.

- Affordable housing figures are calculated separately and listed in the complete report.

- Office buildings in Jefferson have an estimated market values are $51-$233 per square foot.

- These properties range in size from 1,731 to 802,000 in square footage and are assessed at $5 - $28 in rent per square foot with 3-14% market vacancy.

A report from the International Association of Assessing Officers stated that commercial properties in Chicago were underassessed in 2018, which may have shifted some of the property tax burden from commercial properties to residential properties. The 2021 reassessments reflect current market data and commercial property’s share of the market.

Access all residential and commercial reports—including multi-family assessments, detailed studies of residential assessment quality, and commercial data sources and methodology—at cookcountyassessor.com/valuation-reports.

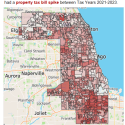

Where is Jefferson Township?

Jefferson Township follows Western Avenue at its eastern border and North Avenue at its southern border. Its western border follows Harlem Avenue north to the Des Plaines River then north to Higgins. The northern border of Jefferson Township largely follows Higgins and Devon Avenues but extends as far as Touhy Avenue.

Appealing property assessments

If the property characteristics listed on an assessment notice are incorrect, or if the estimated market value of a property is significantly more than what it could sell for in the current real estate market, property owners should file an appeal.

Property owners are encouraged to use the Assessor’s Office's new, award-winning online system to file their appeals.

Appeals for Jefferson Township can be filed until September 17th, 2021. More information on filing appeals can be found at cookcountyassessor.com/appeals.

To learn more about property assessments and appeals, join the Assessor’s Office at a virtual event listed here: cookcountyassessor.com/event-list.