Certificate of Error Check

Help us efficiently serve you.

Before you apply for a Certificate of Error for an exemption, please follow the three steps below first to see whether a Certificate of Error has already been issued for you.

|

|

First, find the CCAO's records for your property's PIN: search.

|

|

|

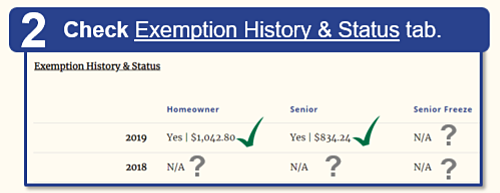

Scroll down to the Exemption History tab. ✔ Yes: The Homeowner and Senior Exemptions were applied to this PIN’s Tax Year 2019 second installment property tax bill due August 3, 2020. This taxpayer already received these savings. They are not eligible for a Certificate of Error for Tax Year 2019. ? N/A: The Senior Freeze exemption was not applied to the second-installment bill for Tax Year 2019, and there were no exemptions applied to the second-installment bill for Tax Year 2018. However, it's possible the Assessor’s Office has already issued any Certificates of Error for these exemptions. Please check the Certificate of Error tab.

|

|

|

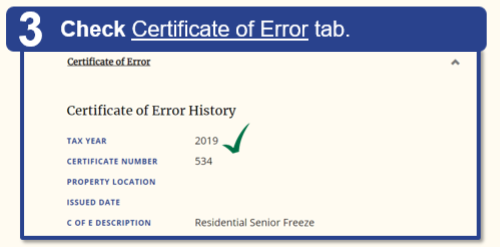

Scroll down to the Certificate of Error tab. ✔ Yes: The Assessor’s Office has already issued a 2019 Certificate of Error for the Senior Freeze exemption for this taxpayer. They do not need to apply for a 2019 Certificate of Error. They will receive a corrected bill automatically. If there was not a Certificate of Error issued in Tax Year 2018, and this taxpayer was eligible for exemption(s) and has already paid this bill, they could apply for a Certificate of Error for Tax Year 2018. Please see instructions, call, or send us a message to confirm before applying. Note: in the interest of privacy, the Assessor's Office website does not display the status of the Longtime, Persons with Disabilities, Veterans with Disabilities, or Returning Veterans exemption. If you believe you are eligible for a Certificate of Error for any these exemptions, please check with Assessor's Office staff first. |

Enter PIN to see property details

Don’t know your PIN? Search by address here.